Last week I shared part 1 of how we clothe our four children on our single-income budget. Today, I’m sharing the second part of how we save on kids’ clothes, including how we take advantage of end-of-season clearance to buy new clothes a year ahead for our children.

Gently Used Clothing (continued from Part 1)

6.Consignment Stores for Children

In our area, we have a few choices for second-hand clothing stores specific to children. By far, my favorite is Once Upon a Child. Most of these stores will screen the clothing they take in (as opposed to accepting anything like some second-hand stores to). Prices reflect the value of clothing items, based on condition of the item and name brand. So, when you buy from such stores, you can be fairly certain that you are buying clothes that are free of holes, stains, rips, excessive fading, etc.

What makes stores like Once Upon a Child so attractive to me is the ability to sell your own gently used clothing to the store in exchange for either cash or store credit! I really appreciate this feature for my daughter’s wardrobe since many of her items are still in excellent condition as she is the only girl.

If any of my children have wardrobe needs, I will take store credit so that I can purchase what is lacking. If I have something else in mind to buy from another store, then I will take cash. Sometimes I even take some of both. Who doesn’t enjoy shopping without having to spend any money? 🙂

- Tips: many of these retailers also accept toys, books, puzzles, baby items, and more.

Pros: wide variety, quality clothing that has been screened, ability to make money

Cons: may not accept all trade-ins, must watch prices carefully (they tend to be a little higher than second-hand stores)

7. Second-hand Stores (Goodwill, Salvation Army, etc.)

Second-hand stores offer a good source of gently used clothing, especially when garage sales are out of season. Local second-hand stores, rather than chain stores like Goodwill, often offer the best value. We have a store in our small town that charges only twenty-five cents per clothing item.

- Tips: Look for 1/2 price days or weekends at chain stores (Goodwill’s is once per month), sack sales, or coupons to save even more money.

Pros: save money buy buying second-hand rather than new, wide variety of items, support charity when shopping some stores.

Cons: prices are often much higher than garage sales (and sometimes even store clearance), some clothing isn’t in the best condition.

8. Facebook Groups and Craigslist

If you are tech-savvy and enjoy shopping online, you can find some great second-hand deals on facebook or craigslist! Many towns and counties have developed online garage sale type pages for users to sell clothing (and other items) locally, much like Craigslist only via facebook.

I have both sold and purchased clothing items on such a group, and the transactions really depend on the people you are dealing with. Some sellers/buyers are very honest and easy to work with, while others are just out to make a buck.

Also, safety can be a concern since you will have to meet the party who is selling/buying in order to complete the transaction. Always, always, always meet in a public place and never go alone if you can avoid it.

Pros: local buying and selling, better pricing than many second-hand stores, easy to find seasonal items like Christmas apparel and Halloween Costumes

Cons: little to no regulation of items being sold, no way to leave feedback for negative transactions, need to arrange meetings, less variety than a second-hand store

Buying Brand New

9. Shop Clearance at Retail Stores

Shopping clearance is really a hobby of mine. 🙂 I like to shop, but our budget is tight and I want to be a good financial steward of the finances God provides for us. I also know that material things are only transient, so I don’t want to place a high value on them. Finding a clearance rack allows me to meet needs while also enjoying my hobby. 🙂

Shopping end-of-season clothing in particular allows us to buy new, quality clothing at second-hand (sometimes even garage sale) prices. Such items are particularly helpful for our boys since most items will be handed down twice, and some even survive well enough to be passed on to younger cousins!

However, clearance shopping is one area in which I must exercise caution. The excitement of a good bargain often leads to over-spending or over-buying (how many skirts does one preschool girl really need?!). Additionally, department stores thrive on marking items up and then promoting a sale thereby convincing consumers they are getting a bargain when, in truth, they are not. So, before I share my rules for clearance shopping with you, I must caution you not to blow your clothing budget by making the same mistakes I have.

- Tips: Before you attempt to shop end-of-season sales for next year’s wardrobes, know your prices (takes time and research), know your budget, and know your needs (keep a list if you need to). My favorite stores for buying quality clearance clothing are JC Penneys, Kohls, The Children’s Place, Old Navy, and occasionally Walmart.

Rules for Bargain Shopping

Buy When:

- the item is needed (either currently or for the next year)

- you see evidence of multiple markdowns already

- you have extra percent off of already reduced prices (I like to wait until items are 70-90% off original prices. For online buying, check for coupon codes at retailmenot.com)

- you will earn rewards to buy other needed items (such as Kohls cash)

Exercise caution when:

- you’re tempted by price alone

- the item will be difficult to match (example: a girls’ skirt with a weird color of pink or purple in it)

- end of season clearance has just begun (I’ve learned that some stores, Kohls in particular, mark some things as “clearance” that are really just their normal sale prices. If you wait for a few weeks, you’re likely to see much better discounts.)

Why buy a year ahead?

Whenever possible, I take advantage of seasonal clearance to buy a year ahead for our children (I mentioned this in Part 1 in the Garage Sale section). Thinking ahead is a technique I learned from couponing, and it makes a lot of sense. When prices are extremely low, buy more than you need for the present so that when you need the item in the future, you will not have to pay regular price. For clothing, that translates to buying a size or so larger for the next year.

For example, when summer clothes go on clearance, I think about what they will need for their wardrobes next summer, including swimsuits and footwear. Thinking ahead is particularly helpful for items that tend to be more costly, such as Easter and Christmas dress clothes. Example: Once I found a toddler boys’ Christmas suit (vest and tie included) for $1.97, so I bought it even though it would not fit our son for 2 more years.

The only two downsides to buying ahead is that your budget might not allow for extra purchases (even frugal ones) and you may not have the storage space necessary to keep clothing for a year, especially if you already have several children. In those cases, check for an area of the budget you can pull a little extra cash from (such as food) and ask friends or family for storage space in a garage or attic.

Once you have built up a little clothing in storage, buying ahead will not be as much of a stretch for your budget because you won’t be purchasing as many items for immediate needs.

- Tips: Be sure to pay attention to how their current clothing fits and their general body type. For example, I’ve learned that our children all have my husband’s long torso, so I usually have to buy one size larger in shirts than in pants. Additionally, our only daughter is quite thin, so regular pants often look like clown pants on her. Thus, when buying ahead for her, I only purchase leggings and skinny jeans or slim sizes.

- Disclaimer: Buying ahead may not work as well in the teen years when youths are prone to skipping whole sizes at once – we’re still learning about these years as our oldest is about to turn 14! 🙂

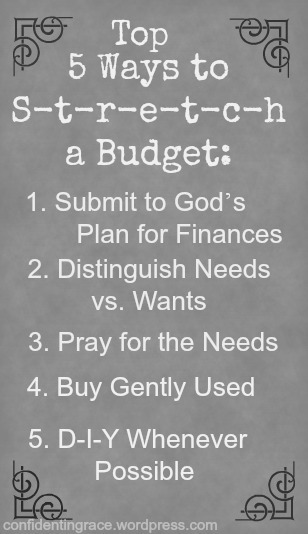

That wraps up part 2 of how we save money on kids’ clothes in an effort to live frugally. Saving money on clothing is just one way that we stretch our budget; for more ideas, read 5 Ways to S-t-r-e-t-c-h a Budget. I hope you find this information helpful!

Jen 🙂

You may find me linking up at any of these lovely places.