Today on Mama Monday, I want to touch on the matter of saving money! I know in these tough times, many families are looking for ways to stretch the budget. I also know that my husband and I learned several difficult lessons about finances early on in our marriage. So, as a family of six living on a single income, I’d love to share with you how we make our tight budget work! 🙂

Growing up an MK (missionary kid) taught me many life lessons. I’ve seen what it is to truly be in need. I know in many areas of the world, children often go hungry and families sleep on the bare dirt floors of a thatched jungle hut. I’ve witnessed firsthand the difference between needs (for survival) and wants (for pleasure). I’ve also seen our Father God provide for our family in some amazing ways – money for shoes sent from another state, postmarked before we even prayed for it!

So, when my husband and I first joined our lives together, it’s not surprising that some of our first arguments were over money – how to spend it. 🙂 I was very reluctant to spend our finances on anything I did not deem a need and my husband was more laid-back in his approach to finances.

However, a few short months later, we found ourselves expecting our first child and my husband without a job. During that time of zero income, I forgot those missionary kid lessons. I forgot that when we have needs, we turn to our Heavenly Father for help.

Matthew 6

25 “For this reason I say to you, do not be worried about your life, as to what you will eat or what you will drink; nor for your body, as to what you will put on. Is not life more than food, and the body more than clothing? 26 Look at the birds of the air, that they do not sow, nor reap nor gather into barns, and yet your heavenly Father feeds them. Are you not worth much more than they? 27 And who of you by being worried can add a single hour to his life? 28 And why are you worried about clothing? Observe how the lilies of the field grow; they do not toil nor do they spin, 29 yet I say to you that not even Solomon in all his glory clothed himself like one of these. 30 But if God so clothes the grass of the field, which is alive today and tomorrow is thrown into the furnace, will He not much more clothe you? You of little faith! 31 Do not worry then, saying, ‘What will we eat?’ or ‘What will we drink?’ or ‘What will we wear for clothing?’ 32 For the Gentiles eagerly seek all these things; for your heavenly Father knows that you need all these things. 33 But seek first His kingdom and His righteousness, and all these things will be added to you.

34 “So do not worry about tomorrow; for tomorrow will care for itself. Each day has enough trouble of its own.

………………………

As a result of trusting in our own abilities rather than in the Lord, we quickly found ourselves in debilitating debt. It took 5 long years to dig out of the money pit we created. Since then, we have grown tremendously in our financial stewardship, mostly out of pure necessity.

I praise the Lord for the work He has done in overhauling our money mindset! Today, being a stay-at-home mom of four, I contribute very little to our family finances, so making the most of what we have is not optional – it’s mandatory!

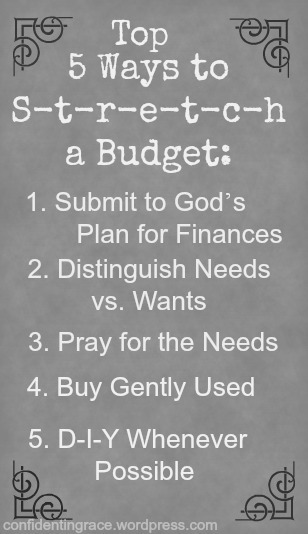

I often field questions from others on how we make a single income work for our larger than average family (although I know many much larger than ours). So, I asked my husband to help me make a list of the areas in which we save money so that we can achieve our financial goals, the primary goal being that I am free to stay home with our children, and a secondary goal being to eventually live debt-free (that’s the work-in-progress part). 🙂

I hope you find these budget-stretching tips helpful!

***Disclaimer – this is not a post about whether or not women should stay home or go to work. That is a decision for each family to make with God’s guidance, and I recognize that some families just don’t have that option. Additionally, it is not a post to brag about our money-saving budget – it truly is by God’s grace alone that we are no longer living paycheck to paycheck and we still have much growing left to do. This is a post on ways to stretch the budget if you are looking for help – how we make a single income (a pastor’s salary) work for our family of six. 🙂

1. Follow God’s Plan for Finances

Start with a Budget! It seems obvious, but many people don’t have a detailed budget, or they have one that they don’t follow. (Of course, we always stick to ours….Ha!) If you don’t have one, make one. If you don’t know how, ask someone for help. If you aren’t sure where to start, visit Crown Financial Ministries for some helpful tools.

Pay off Debt – OR better yet, try not to take on any debt in the first place; instead trust God to provide for your needs. Oh, how I wish I had understood how interest works earlier on in life! If you are already overwhelmed by debt, check into Credit Counselors’ Corporation or a similar non-profit group as soon as possible. The longer you wait, the worse it will get. Trust me – we’ve walked that path before! 🙂

Offerings – For us, giving a regular offering is non-negotiable. However, it was not always so! When first married, we were both still in college, so our income was very, very small, at times non-existent. So, we didn’t give consistently and usually what we did give was the leftovers at the end of the week. In time, however, we both became convicted that giving needed to be a priority.

We started very small: only five dollars a week. But we gave faithfully, and little by little God helped us to increase it. And while we wondered where our food was going to come from, He continued to provide! I want to encourage you that even if you have so very little at the moment, you can still be obedient to the Lord in this area. Even if the amount seems too small to matter, remember that it’s not about the money, it’s about the heart. I’ve heard that “you can never out-give God.” Test Him!

Luke 21:1-3 “And He looked up and saw the rich putting their gifts into the treasury. And He saw a poor widow putting in two small copper coins. And He said, “Truly I say to you, this poor widow put in more than all of them…”

Savings – For our family, savings is also as non-negotiable as we can possibly make it. Of course, sometimes things come up –something major breaks on the minivan, someone becomes ill, etc. For us, savings is definitely still a work in progress, but the goal is to have savings built up for each one of those occurrences so that we don’t have to take money from our budget to meet those additional expenses.

2. Distinguish Needs vs. Wants

Cable TV/Internet – We realized early in our marriage that for us, the expense was a want, not a need, and we simply didn’t have room for it in our budget. So, for many years we used an antenna when we wanted visual entertainment, or a VCR. Today, we splurge on Netflix – $7.99 plus tax per month. 🙂 Additionally, Internet service is not really a need (unless you work from home), but we choose to splurge on it now that we have room in our budget. If you are struggling to meet your monthly budget, these are two expenses that can probably go.

Cell Phones – I recently read that average cell phone bills for single users are upwards of $71, and for a family of four, as much as $200! That’s a lot of money to pay out every month for a “want”! What has worked to keep our costs low is using Tracfone, Net10, and other prepaid companies. (Update: currently we use a company called Consumer Cellular – 3 lines on a shared plan for $67.00/ month!)

We receive all of the advantages of cell phone usage (even data plans) without being tied to a contract, and since our company pays to use larger companies’ towers (like Verizon and AT&T), we rarely lose signal! If a cell phone is a true need for you because of work, etc., consider changing to a less expensive company or plan. If you can’t change your cell phone to a lower-cost plan at this time, consider getting rid of your home phone altogether and save in that area, or consider downsizing to one shared cell phone.

Clothing – This area is probably the one in which we stretch our budget the most. Growing up an MK, I wore whatever clothes were available, plain and simple. Brand name loyalty was not an option for our family back then, and it’s not an option for my family now! Don’t get me wrong – I love nice clothing, but buying new wardrobes for our children every year is not feasible for our budget.

Clothing three children, one teen, and two adults can be a challenge, but we’ve found a variety of ways to save (check out 9 Ways to Save on Kids Clothes). Clothing for adults is more challenging, but garage sales and thrift stores can still be useful. When we have a clothing need, I often take it to the Lord in prayer before I start shopping around. I can’t tell you how many times we’ve been blessed with bags of clothing from friends, church family, neighbors, and even a well-timed garage sale!

Philippians 4:6-7

Be anxious for nothing, but in everythingby prayer and supplication with thanksgiving

let your requests be made known to God.

And the peace of God, which surpasses all comprehension,

will guard your hearts and your minds in Christ Jesus.

Food – Again, we don’t have the luxury of caring about brands. Although, I readily admit that I am toilet paper snob . The cheap brands just don’t cut it. 🙂 To save money on food and toiletries, I buy store brands and shop at stores like Aldi’s, as well as local farmers markets (when in season). In the last few years, I have also learned a great deal about couponing! I know, I know – not everyone loves using coupons, but it works for us. (Yes, I have a small stock-pile. No, I’m not one of those extreme couponers with a basement full of paper towel). 🙂

Another way to keep grocery bills low is to create a menu and shop for only the items you need for that menu. This really works for our family. I also cook from scratch (or nearly from scratch) almost every night of the week, rather than buying pre-made meals or eating out, although we do splurge by eating out on occasion (dollar menu, anyone?).

Bottom line: always keep in mind the question of whether the item you want to purchase is truly a need or if it’s just a want. Once you have honestly assessed the situation, then you can decide whether or not to fund the purchase even if it is a want. I also cannot emphasize enough how prayer impacts the way in which we use our limited finances. Often, when we have a need, if I cannot find the item at a price we can afford, I wait…

And He provides.

Please join me for the second half of 5 Ways to Stretch a Budget with more practical ways to save!

Jen 🙂

Have a tip to share? Comment with your best money-saving advice!

Recommended Resources:

*This blog makes use of affiliate links. For more information, visit Being Confident of This ‘s About page.